Oct 7, 2023This figure is calculated by subtracting total liabilities from total assets; alternatively, it can be calculated by taking the sum of share capital and retained earnings, less treasury stock. This

Solved 1. Analyze the effects of alternative distributions | Chegg.com

This paper investigates the ability of five alternative distributions to represent the behavior of daily equity index returns over the period 1979-2014: the skewed Student- t distribution, the generalized lambda distribution, the Johnson system of distributions, the normal inverse Gaussian distribution, and the g-and-h distribution.

Source Image: 1stformations.co.uk

Download Image

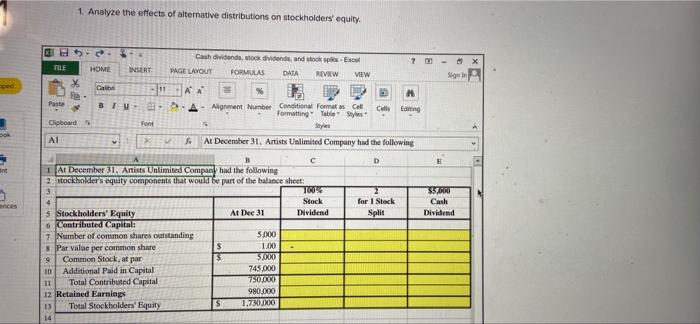

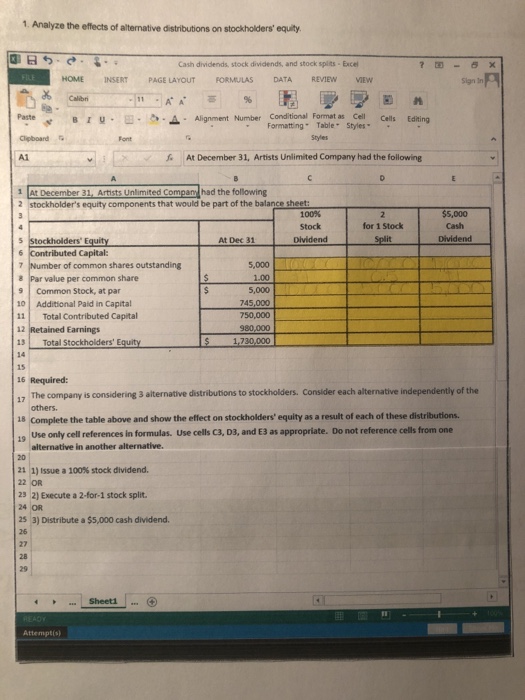

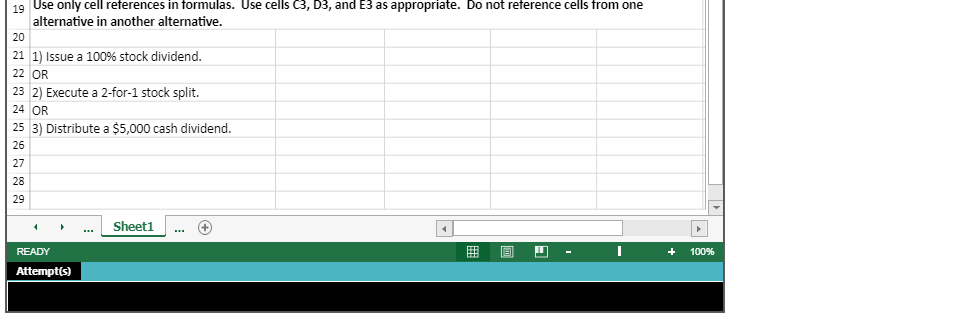

Consider each alternative independently of the others 1 Complete the table above and show the resulting balances on the stockholders’ equity section as a result of these distributions Is We only cell references in formulas. Use cell C, D3, and as appropriate.

Source Image: coursesidekick.com

Download Image

What is a Product Life Cycle Analysis and Management – AI Digital Marketing Agency In comparing the stockholders’ equity section of the balance sheet before and after the large stock dividend, we can see that the total stockholders’ equity is the same before and after the stock dividend, just as it was with a small dividend (Figure 14.10). Figure 14.10 Stockholders’ Equity Section of the Balance Sheet for Duratech.

Source Image: chegg.com

Download Image

Analyze The Effects Of Alternative Distributions On Stockholders’ Equity

In comparing the stockholders’ equity section of the balance sheet before and after the large stock dividend, we can see that the total stockholders’ equity is the same before and after the stock dividend, just as it was with a small dividend (Figure 14.10). Figure 14.10 Stockholders’ Equity Section of the Balance Sheet for Duratech. Jun 22, 2023Stock Dividends is a contra stockholders’ equity account that temporarily substitutes for a debit to the Retained Earnings account. … the date of distribution is the date the shares are actually distributed to stockholders. Declared a 2% stock dividend on 21,000 shares of $10 par common stock outstanding. The fair market value is $15 per

Solved 1. Analyze the effects of alternative distributions | Chegg.com

Consider each alternative independently of the others. 18 Complete the table above and show the resulting balances on the stockholders’ equity section as a result of these distributions 9 Use only cell references in formulas. Use cells C3, D3, and E3 as appropriate. Do not reference cells from one alternative in another alternative Sheet1 Determining the Final Value in M&A Transactions – Midaxo

Source Image: midaxo.com

Download Image

What is a down round and how to avoid one | Toptal® Consider each alternative independently of the others. 18 Complete the table above and show the resulting balances on the stockholders’ equity section as a result of these distributions 9 Use only cell references in formulas. Use cells C3, D3, and E3 as appropriate. Do not reference cells from one alternative in another alternative Sheet1

Source Image: toptal.com

Download Image

Solved 1. Analyze the effects of alternative distributions | Chegg.com Oct 7, 2023This figure is calculated by subtracting total liabilities from total assets; alternatively, it can be calculated by taking the sum of share capital and retained earnings, less treasury stock. This

Source Image: chegg.com

Download Image

What is a Product Life Cycle Analysis and Management – AI Digital Marketing Agency Consider each alternative independently of the others 1 Complete the table above and show the resulting balances on the stockholders’ equity section as a result of these distributions Is We only cell references in formulas. Use cell C, D3, and as appropriate.

Source Image: matrixmarketinggroup.com

Download Image

Banks Could Increase Annual Revenues by Nearly 4% by Embracing Innovative Business Models of Digital-Only Players, Accenture Report Finds Sep 13, 2023Updated September 13, 2023 Reviewed by JeFreda R. Brown When a company pays cash dividends to its shareholders, its stockholders’ equity is decreased by the total value of all dividends paid;

Source Image: newsroom.accenture.com

Download Image

Solved 1. Analyze the effects of alternative distributions | Chegg.com In comparing the stockholders’ equity section of the balance sheet before and after the large stock dividend, we can see that the total stockholders’ equity is the same before and after the stock dividend, just as it was with a small dividend (Figure 14.10). Figure 14.10 Stockholders’ Equity Section of the Balance Sheet for Duratech.

Source Image: chegg.com

Download Image

Issues Related to Balance Sheet Modifications, Earnings Normalization, and Cash Flow Statement Related Modifications on a Company’s Financial Condition – CFA, FRM, and Actuarial Exams Study Notes Jun 22, 2023Stock Dividends is a contra stockholders’ equity account that temporarily substitutes for a debit to the Retained Earnings account. … the date of distribution is the date the shares are actually distributed to stockholders. Declared a 2% stock dividend on 21,000 shares of $10 par common stock outstanding. The fair market value is $15 per

Source Image: analystprep.com

Download Image

What is a down round and how to avoid one | Toptal®

Issues Related to Balance Sheet Modifications, Earnings Normalization, and Cash Flow Statement Related Modifications on a Company’s Financial Condition – CFA, FRM, and Actuarial Exams Study Notes This paper investigates the ability of five alternative distributions to represent the behavior of daily equity index returns over the period 1979-2014: the skewed Student- t distribution, the generalized lambda distribution, the Johnson system of distributions, the normal inverse Gaussian distribution, and the g-and-h distribution.

What is a Product Life Cycle Analysis and Management – AI Digital Marketing Agency Solved 1. Analyze the effects of alternative distributions | Chegg.com Sep 13, 2023Updated September 13, 2023 Reviewed by JeFreda R. Brown When a company pays cash dividends to its shareholders, its stockholders’ equity is decreased by the total value of all dividends paid;